November 4, 2016 - QB’s execution simulator is an important tool for developing and evaluating our algorithms.

Read MoreSeptember 14, 2016 - In response to strong client demand, Quantitative Brokers (QB) has developed a new algorithm called Closer benchmarked to the daily settlement price.

Read MoreFebruary 12, 2016 - Algorithmic futures trading has recently become very popular among the world’s largest commodity trading advisors (CTAs), global macro hedge funds, pension funds and asset managers.

Read MoreAugust 6, 2015 - Different futures products show markedly different distributions of activity across contract months.

Read MoreJune 18, 2015 - On the morning of October 15, 2014, between 9:35 and 9:45 New York time, yields on US Treasury securities underwent their largest single-day drop since 2009, and quickly recovered.

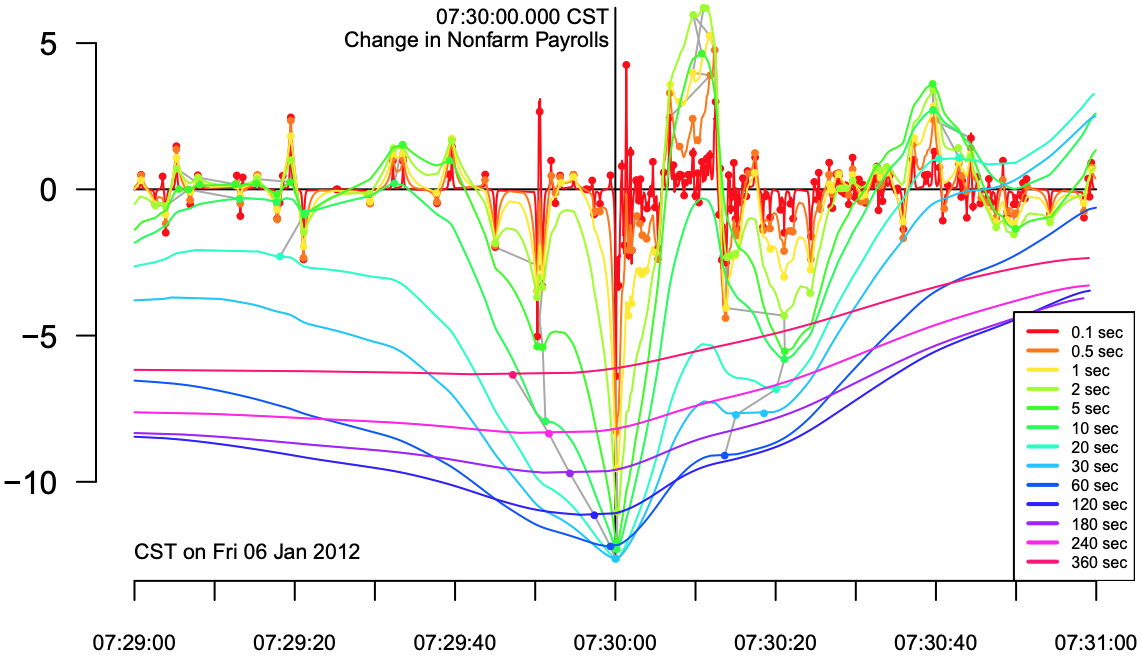

Read MoreJune 11, 2015 - We track 62 unique macroeconomic events and calibrate our volume forecasts to the effect of each data release.

Read MoreJune 9, 2015 - A brief report in the context of the June 9 WSJ article, which discusses a decline in the bids to debt ratio of the 10-year Gilts.

Read MoreMay 30, 2014 - Overall volume has been steadily increasing following a low point at the end of 2008.

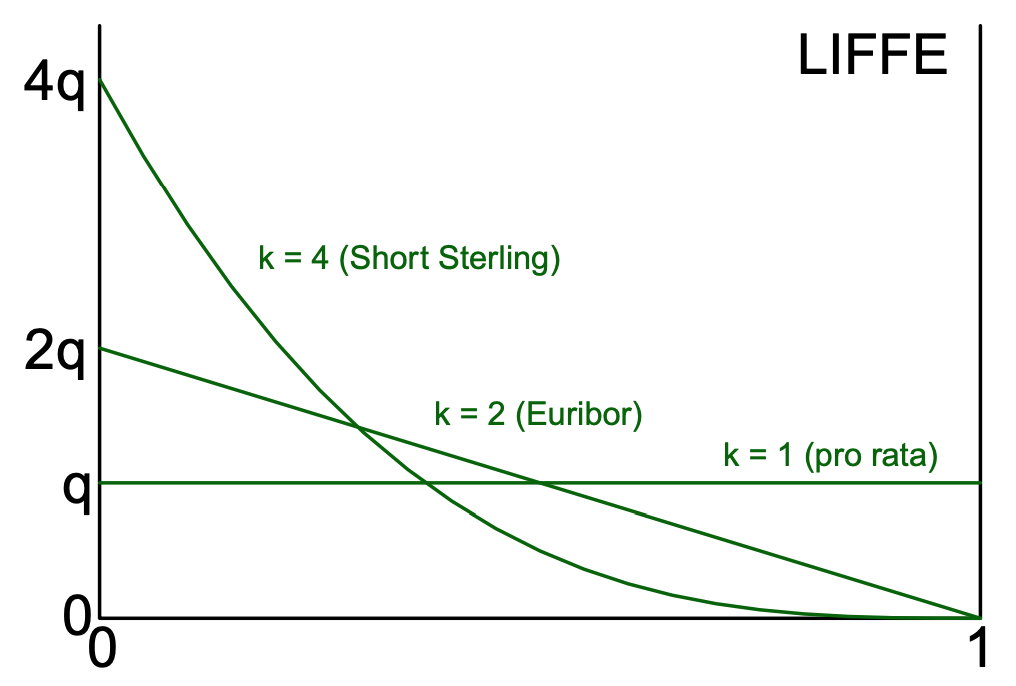

Read MoreMay 31, 2013 - Effective May 29, 2013, the NYSE LIFFE exchange announced a change to the pro rata trade matching algorithm.

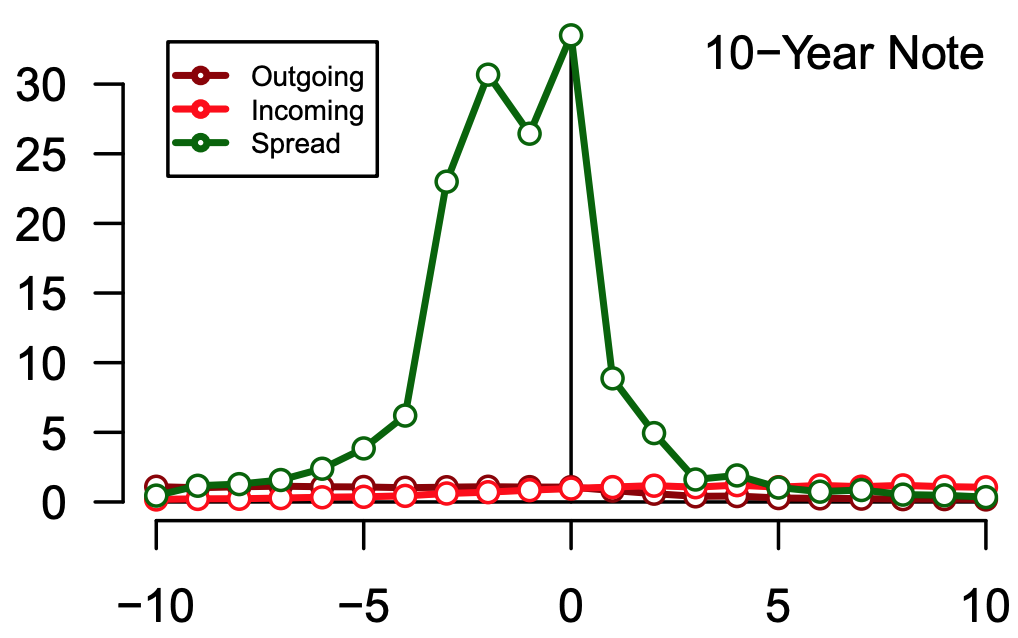

Read MoreJune 26, 2012 - We investigate the effect of scheduled information releases and auctions on high-frequency trading of interest rate futures on the Eurex exchange, and compare with similar products on CME.

Read MoreAugust 25, 2011 - The Treasury futures roll occurs quarterly with the March, June, September, and December delivery cycle of Treasury futures contracts.

Read MoreMay 26, 2011 - We track 62 unique macroeconomic events and calibrate our volume forecasts to the effect of each data release.

Read More